Our List Of The 6 Cheapest Cars to Insure In 2022

When it comes to motor running costs, insurance can often be the biggest expenditure. If you’d prefer to keep costs down, we’ve compiled a list of cars in low insurance groups.

All cars are placed in a group between one and 50, with one being the cheapest and 50 the most expensive. The insurance group depends on factors such as the car’s security, performance, repair times, safety and value.

Whether you’re looking for low-cost insurance for a first-time driver, or simply looking to spend less money each month; check out our shortlist of cars with the lowest insurance - we’ve included a nice variety of shapes and sizes.

Are newer cars cheaper to insure?

A common query when it comes to insuring a car is whether newer cars result in higher premiums.

It may seem obvious that older cars are cheaper to insure because they’re less valuable, but this isn’t always the case.

It can be difficult to get replacement parts for older cars, but equally it may cost your insurance provider more to fix or replace a new one.

While cars with smaller engines tend to come with cheap cover, it’s not always the case if the car is new. It’s worth keeping in mind that it may cost your insurance provider more to replace a new car.

In short, the price of car insurance is very specific and depends on the car model itself - so it’s important to get a quote for each one. Another way to reduce the cost of your car is to lease rather than buy. But how popular is car leasing in the UK now?

So, what are the best cars for low car insurance?

Volkswagen Polo (excluding GTi)

Volkswagen Polo

Specification

- Insurance group: 1E

- 0-62 MPH: 10.4 Seconds

- Top Speed: 121mph

- CO2: 128 g/km

- Luggage Capacity: 351 Litres (Seats up), 1380 Litres (Seats down)

Volkswagen Polo leasing prices start from £182.67 exc. VAT per month

Hailed as the new Golf, the VW Polo is where it’s at. It’s reliable, stylish and cheap to insure. The newest model comes with an updated infotainment system, it has a modern feel - and compared to other small cars, the comfortable interior comes with plenty of legroom.

Citroen C1

Citroen C1

Specification

- Insurance group: 1E

- 0-62 MPH: 14 Seconds

- Top Speed: 99mph

- CO2: 110 g/km

- Luggage Capacity: 196 Litres (Seats up), 780 Litres (Seats down)

If you were to think of a cheap car to insure, we’re sure that the Citroen C1 comes to mind. This pocket-sized city car is the perfect choice for youngsters, with its small interior, wheels and low insurance.

What it lacks in substance and acceleration, it makes up for in manoeuvrability around town - not to mention that it can park in the smallest of spaces. There’s even just enough space for four adults and bags in the boot.

Volkswagen Up!

Volkswagen Up!

Specification

- Insurance group: 1E

- 0-62 MPH: 8.8 Seconds

- Top Speed: 122mph

- CO2: 125 g/km

- Luggage Capacity: 251 Litres (Seats up), 959 Litres (Seats down)

Unlike other small city cars, the Up doesn’t feel like it’s dwarfed by lorries on the motorway, and is substantial enough to take corners with ease.

With a broad, boxy body, there’s plenty of room for four adults and bags in the boot - and the interior is as impressive as you’d hope from a VW.

The quiet, 60PS engine doesn’t guzzle fuel, and it comes with great features such as air conditioning, Bluetooth connectivity and DAB radio.

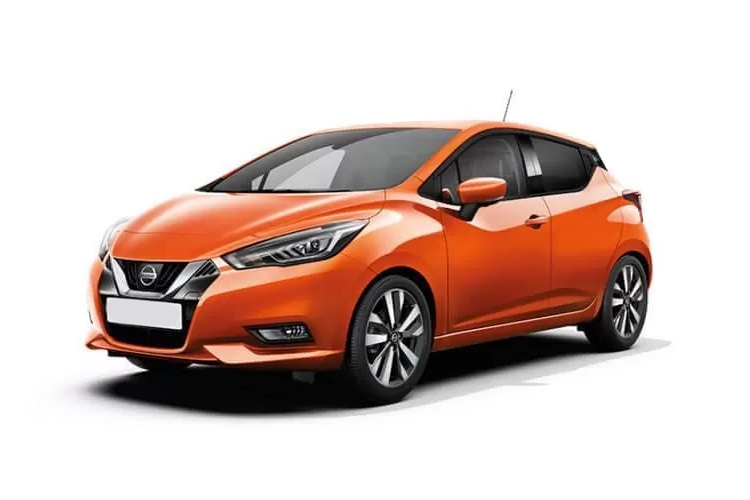

Nissan Micra

Nissan Micra

Specification

- Insurance group: 1E

- 0-62 MPH: 13 Seconds

- Top Speed: 106mph

- CO2: 142 g/km

- Luggage Capacity: 300 Litres (Seats up), 59 Litres (Seats down)

A reasonable alternative to the Volkswagen Polo, the Nissan Micra performs like a small car but in a larger body.

The newer version is more aesthetically pleasing than the classic Nissan Micra, and it has a neat interior with a full infotainment screen.

The suspension makes it relatively smooth over bumps, but performance is what you’d expect from a low insurance group vehicle.

Ford Fiesta

Ford Fiesta

Specification

- Insurance group: 2E

- 0-62 MPH: 9.4 Seconds

- Top Speed: 124mph

- CO2: 115 g/km

Ford Fiesta leasing prices start from £239.37 exc. VAT per month

Looking for a car that doesn’t sacrifice an enjoyable driving experience for cheap cover? Then the Ford Fiesta is the car for you.

It has everything you might need: a large infotainment screen, air conditioning and smart interiors. With excellent steering and balanced pedals, it’s certainly fun to drive - and takes corners with ease.

SEAT Ibiza

SEAT Ibiza

Specification

- Insurance group: 2E

- 0-62 MPH: 10.9 Seconds

- Top Speed: 116mph

- CO2: 124 g/km

- Luggage Capacity: 355 Litres (Seats up)

SEAT Ibiza leasing prices start from £180.54 exc. VAT per month

The SEAT Ibiza is another great contender for a Polo-style car, in fact, the Volkswagen Polo shares parts with SEAT.

It has a pretty decent interior for a small car, with five doors, a good amount of legroom for four adults and a 355-litre boot. All models come with alloy wheels and a leather steering wheel, which is quite a nice touch given that it’s a 1.0-litre engine.

Overall, the Ibiza is nice to drive - but we recommend opting for the turbocharged trim if you’re planning longer journeys.

Now that you’ve seen the best cars for low car insurance, you probably have a better idea of what you can get for your money. Making the switch to Electric is also a great option, here is why now is the best time to get an electric car.

If a dinky city car is the right fit for you, then you’re sure to find some great deals on cheap cover. Otherwise, rest assured that there are more spacious or smoother models available in low insurance groups. Not that you are you up on insurance, next it is time to learn about the changes made to the highway code in 2022?

If you like the look of any of these cars, give us a call on 01273433480 to discuss car leasing. Alternatively, you can request a callback for a time that is convenient for you!